is it smart to do balance transfers on credit cards A balance transfer can save you money by moving your debt from a high-interest credit card to one with a lower APR. Learn how they work, and find a card that fits your needs. $126.00

0 · why balance transfer credit card

1 · should i transfer my balance

2 · credit card balance transfer disadvantages

3 · best 0% balance transfer offers

4 · balance transfer vs paying off

5 · balance transfer pros and cons

6 · balance transfer credit card meaning

7 · balance transfer credit card downsides

The NFC Business Card from wCard.io has been a game-changer for our company. .

why balance transfer credit card

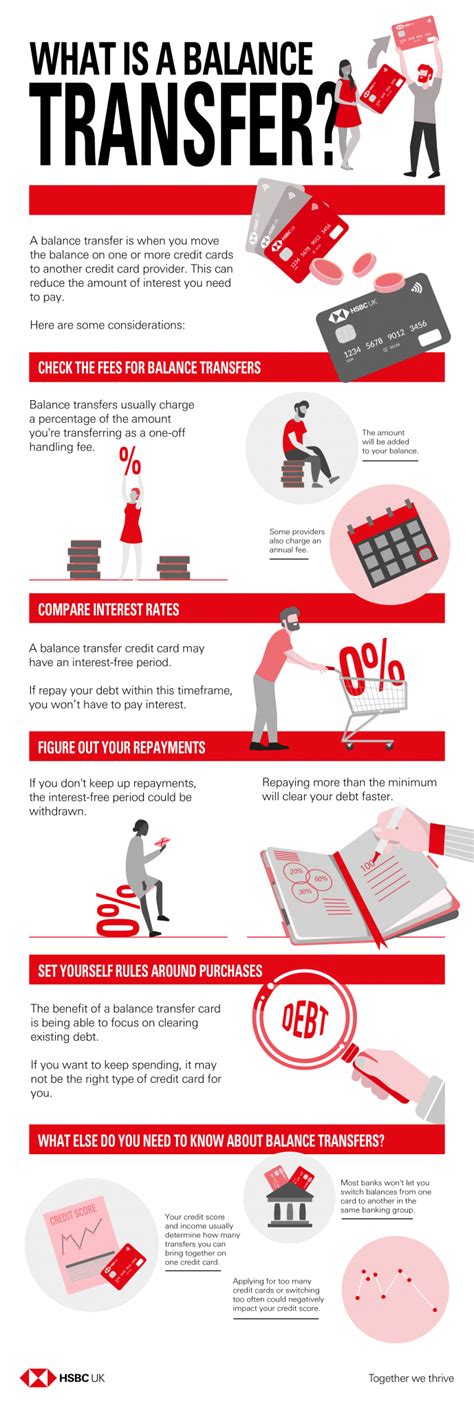

Balance transfer credit cards help you save money by allowing you to move debt from a high-interest credit card to one that charges as little as 0% APR for 12 months or longer. They can also help you consolidate your debt into a single payment if you owe money on .

should i transfer my balance

A balance transfer can save you money by moving your debt from a high . Balance transfer credit cards help you save money by allowing you to move debt from a high-interest credit card to one that charges as little as 0% APR for 12 months or longer. They can also help you consolidate your debt into a single payment if .

A balance transfer is the process of transferring debt from one credit card to another credit card, usually to one with a lower interest rate. This doesn’t get rid of your debt but it may help you save money on interest or possibly pay off the debt quicker. A balance transfer can save you money by moving your debt from a high-interest credit card to one with a lower APR. Learn how they work, and find a card that fits your needs.Balance transfer credit cards have a lot to offer for those struggling with debt. For some, a 0% introductory rate on balance transfers can shave years off of debt repayment and save.

A balance transfer credit card can help you pay off your debt faster and save money on interest, but it may not be the right move for everyone. Balance transfer credit cards offer.

Balance transfer credit cards can be helpful tools for zapping debt, but they aren't a cure-all and require you to avoid certain pitfalls. Benefits of balance transfer credit cards. In short, a balance transfer card can help you save money and simplify your financial life. Here’s how: Lower interest charges: You can save.

credit card balance transfer disadvantages

best 0% balance transfer offers

customized custom uv printed rfid blocking card

The smartest way to use a credit card is to pay off your statement balance in full by the due date every month. This good habit can help you in two important ways. When you avoid.

A balance transfer allows you to consolidate your debts to a single account, often a credit card, and benefit from a lower interest rate. This can help you save money on interest payments. However, note that the lower interest rate is usually an introductory offer that lasts for a limited time, generally between six and 18 months.

A balance transfer credit card can be a powerful tool in your debt-busting arsenal. A 0% introductory APR offer on a credit card can save money by having all your payments go toward. Balance transfer credit cards help you save money by allowing you to move debt from a high-interest credit card to one that charges as little as 0% APR for 12 months or longer. They can also help you consolidate your debt into a single payment if .

A balance transfer is the process of transferring debt from one credit card to another credit card, usually to one with a lower interest rate. This doesn’t get rid of your debt but it may help you save money on interest or possibly pay off the debt quicker. A balance transfer can save you money by moving your debt from a high-interest credit card to one with a lower APR. Learn how they work, and find a card that fits your needs.

Balance transfer credit cards have a lot to offer for those struggling with debt. For some, a 0% introductory rate on balance transfers can shave years off of debt repayment and save. A balance transfer credit card can help you pay off your debt faster and save money on interest, but it may not be the right move for everyone. Balance transfer credit cards offer. Balance transfer credit cards can be helpful tools for zapping debt, but they aren't a cure-all and require you to avoid certain pitfalls.

Benefits of balance transfer credit cards. In short, a balance transfer card can help you save money and simplify your financial life. Here’s how: Lower interest charges: You can save. The smartest way to use a credit card is to pay off your statement balance in full by the due date every month. This good habit can help you in two important ways. When you avoid. A balance transfer allows you to consolidate your debts to a single account, often a credit card, and benefit from a lower interest rate. This can help you save money on interest payments. However, note that the lower interest rate is usually an introductory offer that lasts for a limited time, generally between six and 18 months.

balance transfer vs paying off

balance transfer pros and cons

The NFL's wild card round of the playoffs will feature six games spread out over Jan. 13-15. All start times are in ET. Saturday, Jan. 13: AFC/NFC wild card matchup, 4:30 p.m.,.Find out which teams are winning the 2024 playoff race. Check out the NFL Playoff Picture for the latest team performance stats and playoff eliminations. Learn more.

is it smart to do balance transfers on credit cards|should i transfer my balance