is getting a loan to pay off credit cards smart I’m wondering what folks think about taking a personal loan to pay off credit card debt. I have around $7000 in credit card debt and I’m looking to basically consolidate it all to be able to pay it off more easily and hopefully more quickly.

The Company shall not be liable for any loss or accidental damage of the .

0 · personal loans for credit cards

1 · personal loan to pay off credit card debt

2 · personal loan for credit card payment

3 · paying off credit card debt

4 · pay off credit card debt online

5 · loans to pay off credit cards

6 · loan to pay credit card debt

7 · borrow money to pay credit card

cardpeek, free download for Windows. Software to analyze and read data on smart cards, including credit cards, ID cards and more. . NFC and RFID. cardpeek is an NFS and RFID smartcard reader. . cardpeek can be .

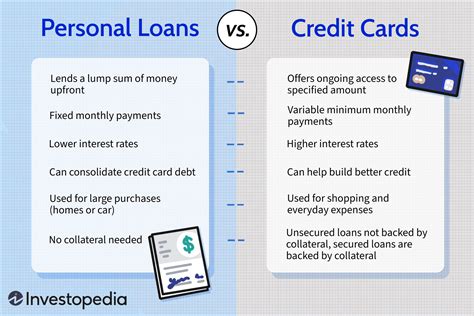

Key takeaways. Using a personal loan to pay off credit card debt could be a . Considering a personal loan to pay off credit card debt? Some personal loans offer lower interest rates than credit cards. So consolidating your credit card debt with a personal loan may save you money on interest and potentially help you get out of debt faster. Key takeaways. Using a personal loan to pay off credit card debt could be a smart move if you can secure a lower rate or are juggling multiple credit card payments. Paying off credit card. With a personal loan, you can pay off your credit card debt right away and set up a payment plan to repay your personal loan. Terms vary based on how much you borrow and your lender, but a.

Paying off your credit card debt with a personal loan could make sense if you can save money on interest and avoid charging your newly cleared cards.I’m wondering what folks think about taking a personal loan to pay off credit card debt. I have around 00 in credit card debt and I’m looking to basically consolidate it all to be able to pay it off more easily and hopefully more quickly.

Using a personal loan to pay off credit card debt can save money on interest and simplify monthly payments. Personal loans are still a form of debt, and it’s important not to rack. Pros and cons of taking out a personal loan to pay off credit card debt. Interest rates are typically lower than credit cards. One fixed monthly payment can make debt management easier.. Yes, you can use a personal loan to pay off credit cards. In many cases, that’s a smart move as it will let you pay off the debt over time with a lower interest rate than credit card interest.

Using a personal loan to pay off credit cards may make sense in certain situations. Here are some of the potential benefits. Lower interest rates. Personal loans tend to offer lower interest rates than credit cards. And if you have excellent or good credit, you may qualify for an even lower rate. Using a personal loan to pay off credit cards can be a smart move. But it’s crucial to consider a few things before deciding to do so. Compare the interest rates: If the personal loan.

Considering a personal loan to pay off credit card debt? Some personal loans offer lower interest rates than credit cards. So consolidating your credit card debt with a personal loan may save you money on interest and potentially help you get out of debt faster. Key takeaways. Using a personal loan to pay off credit card debt could be a smart move if you can secure a lower rate or are juggling multiple credit card payments. Paying off credit card. With a personal loan, you can pay off your credit card debt right away and set up a payment plan to repay your personal loan. Terms vary based on how much you borrow and your lender, but a.

Paying off your credit card debt with a personal loan could make sense if you can save money on interest and avoid charging your newly cleared cards.I’m wondering what folks think about taking a personal loan to pay off credit card debt. I have around 00 in credit card debt and I’m looking to basically consolidate it all to be able to pay it off more easily and hopefully more quickly. Using a personal loan to pay off credit card debt can save money on interest and simplify monthly payments. Personal loans are still a form of debt, and it’s important not to rack.

Pros and cons of taking out a personal loan to pay off credit card debt. Interest rates are typically lower than credit cards. One fixed monthly payment can make debt management easier.. Yes, you can use a personal loan to pay off credit cards. In many cases, that’s a smart move as it will let you pay off the debt over time with a lower interest rate than credit card interest. Using a personal loan to pay off credit cards may make sense in certain situations. Here are some of the potential benefits. Lower interest rates. Personal loans tend to offer lower interest rates than credit cards. And if you have excellent or good credit, you may qualify for an even lower rate.

personal loans for credit cards

valid id for sim card registration smart

vitalle smart card france

I have used Otterbox Defenders on the last five or six iPhones, so I naturally got one for my new 15 Pro Max. No issues at with installing it into the case. My issue is that the .NFC only works on iPhone 13 when the display is lifted from housing. Once the top portion of the display is clipped in, NFC no longer functions! Like the display is a barrier to .

is getting a loan to pay off credit cards smart|loans to pay off credit cards