contactless payment limit lloyds a credit card outside uk The table below lets you know the fees for using a Lloyds Bank debit card to make a payment or withdraw cash in a currency other than pounds, or withdraw cash in pounds outside the UK. The Auburn IMG Sports Network is the sports radio network for the Auburn Tigers, the athletic programs of Auburn University. Headquartered in Auburn, Alabama, United States, the radio network includes a maximum of 50 radio stations in Alabama, eastern Mississippi, the Florida Panhandle, and Western Georgia. It is the main rival of the Crimson Tide Sports Network, the radio network of University of Alabama athletics.

0 · contactless credit card limits UK

1 · contactless card payment limits

2 · UK contactless payment limits

3 · Lloyds contactless sign in

4 · Lloyds contactless card

5 · Lloyds bank credit card contactless

6 · Lloyds bank contactless sign in

7 · Lloyds bank contactless card protection

Device authentication: You can log into a device by tapping an NFC-enabled badge or key against its NFC reader. This method is compatible with devices that support NFC for authentication, including Windows Security Key sign-in and various apps that offer single sign-on (SSO) capabilities.

Pay up to £100 by holding your card against a reader if your card is contactless. There’s no need to enter your PIN. Your contactless cards still have the same anti fraud protection as chip and PIN. Change your contactless limit to anything between £30 and £95.

You can check if you're eligible with One Check without affecting your credit score. Our guide on travelling with your credit card, including the cost of using it abroad, travel money tips and .The table below lets you know the fees for using a Lloyds Bank debit card to make a payment or withdraw cash in a currency other than pounds, or withdraw cash in pounds outside the UK.

The UK’s contactless limit is now £100, after rising from £45 limit on October 15th, enabling consumers to make larger purchases without the need for chip and PIN. The majority .

If you see the contactless symbol, it means you can make contactless payments of up to £100. All three networks – Mastercard, Visa and American Express – offer contactless .Pay up to £100 by holding your card against a reader if your card is contactless. There’s no need to enter your PIN. Your contactless cards still have the same anti fraud protection as chip and PIN. Change your contactless limit to anything between £30 and £95.You can check if you're eligible with One Check without affecting your credit score. Our guide on travelling with your credit card, including the cost of using it abroad, travel money tips and useful contact details.The table below lets you know the fees for using a Lloyds Bank debit card to make a payment or withdraw cash in a currency other than pounds, or withdraw cash in pounds outside the UK.

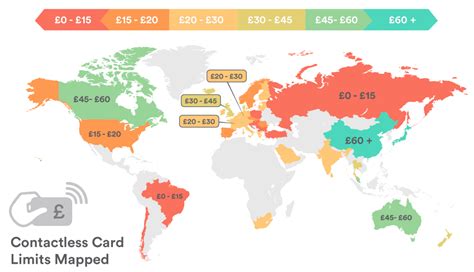

To find the contactless card limit for each country, we used desk research to find accurate and up-to-date news articles, bank information and reports indicating the payment limit of a single contactless transaction. The UK’s contactless limit is now £100, after rising from £45 limit on October 15th, enabling consumers to make larger purchases without the need for chip and PIN. The majority of bank accounts around the world now come with contactless technology, with 88% of debit cards and 81% of credit cards in the UK containing contactless functionality. 1.

If you see the contactless symbol, it means you can make contactless payments of up to £100. All three networks – Mastercard, Visa and American Express – offer contactless payment technology.

contactless credit card limits UK

contactless card payment limits

rfid card holder amazon

The spending limit on each use of a contactless card is to rise from £45 to £100 from 15 October, banks have revealed. The maximum amount was increased from £30 to its current level at the. From 15 October, the contactless card limit will rise from £45 to £100. However, customers of the three banks - which are all part of the Lloyds Banking Group - will be able to use their mobile banking app to set their limits between £30, up to £95. What is the contactless payment limit? The current contactless limit in the UK is £100. Initially, you could typically only authorise contactless payments of £30 and under. The limit was then increased to £45 at the start of the coronavirus pandemic.

Contactless card. Make secure payments with your card wherever you see the contactless symbol. Or add your card to your phone, to make paying even quicker. Paper-free statements. Get your statements delivered online instead of through your letter box.Pay up to £100 by holding your card against a reader if your card is contactless. There’s no need to enter your PIN. Your contactless cards still have the same anti fraud protection as chip and PIN. Change your contactless limit to anything between £30 and £95.You can check if you're eligible with One Check without affecting your credit score. Our guide on travelling with your credit card, including the cost of using it abroad, travel money tips and useful contact details.

The table below lets you know the fees for using a Lloyds Bank debit card to make a payment or withdraw cash in a currency other than pounds, or withdraw cash in pounds outside the UK.To find the contactless card limit for each country, we used desk research to find accurate and up-to-date news articles, bank information and reports indicating the payment limit of a single contactless transaction.

The UK’s contactless limit is now £100, after rising from £45 limit on October 15th, enabling consumers to make larger purchases without the need for chip and PIN. The majority of bank accounts around the world now come with contactless technology, with 88% of debit cards and 81% of credit cards in the UK containing contactless functionality. 1.

If you see the contactless symbol, it means you can make contactless payments of up to £100. All three networks – Mastercard, Visa and American Express – offer contactless payment technology. The spending limit on each use of a contactless card is to rise from £45 to £100 from 15 October, banks have revealed. The maximum amount was increased from £30 to its current level at the. From 15 October, the contactless card limit will rise from £45 to £100. However, customers of the three banks - which are all part of the Lloyds Banking Group - will be able to use their mobile banking app to set their limits between £30, up to £95.

What is the contactless payment limit? The current contactless limit in the UK is £100. Initially, you could typically only authorise contactless payments of £30 and under. The limit was then increased to £45 at the start of the coronavirus pandemic.

rfid card for wallet

UK contactless payment limits

Fans can listen to free, live streaming audio of Auburn Sports Network radio .

contactless payment limit lloyds a credit card outside uk|Lloyds bank credit card contactless